COVID-19 Updates and Resources

Need business help now? We are here for you!

As you face issues related to the coronavirus outbreak, contact us. We will do our

best to provide you with the support you need. We will continue to assist you through remote advising, including email, phone, and Zoom video conferencing.

We will help you identify the next best steps to deal with your specific situation.

Call your WSU Kansas SBDC Advisor or request advising to be assigned to an advisor.

Resources to Help - Short Term and Long Term

COVID-19 small business resource information changes rapidly. The Wichita Regional

Chamber of Commerce Wichita Resource Center on COVID-19 offers a fairly comprehensive site of resources, and it is worth your time. With a

different focus, our WSU Kansas SBDC site will feature

- webinars and information produced by staff from the Kansas SBDC, America's SBDC and the Small Business Administration

- links to resources that we consider particularly helpful

- links to resources provided to us by resource partner organizations

Please Note:

> The SBA will take EIDL applications only from agricultural businesses starting May

4. If you already applied prior to April 15 when the application portal closed, your

applicaiton be reviewed on a first-come, first-served basis.

> The SBA resumed accepting Paycheck Protection Program applications from participating

lenders April 27.

Wichita State University Kansas SBDC Video discussion to help you find your next

best steps in our changing world.

Wichita State University Kansas SBDC Video discussion to help you find your next

best steps in our changing world.

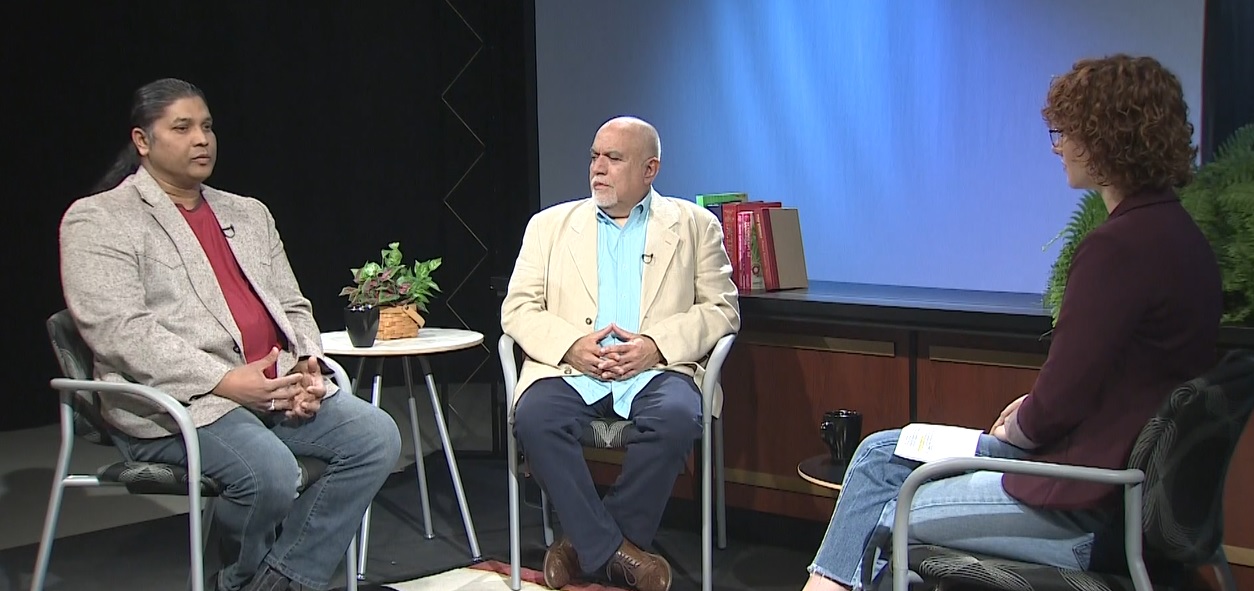

WSU Kansas SBDC Video Discussion: COVID-19 Best Business Practices

The days of business as usual vanished quickly! What actions can you take now to reposition your business for success?

Our staff recorded a short video discussion offering suggestions, tips, and resources

to help you think through ways to reinvent your businesses in these changing times.

WSU Kansas SBDC Associate Director Frank Choriego, WSU Kansas SBDC Marketing Advisor Emily Rishel and Tariq Azmi, vice president of Ember Technology, a local IT company, and a winner of the 2020 Kansas SBDC Emerging Business of the Year Award, discuss the impact of COVID-19 on small businesses and what you can do now to stay successful.

Small Business Updates on COVID-19 Disaster Resources

Our colleagues at the Johnson County Community College Kansas SBDC Regional Center offered this excellent webinar March 30. They cover SBA Disaster Funding, the Family First Coronavirus Response Act, and the CARES Act. They also suggest next steps you can take, including developing a short term cash flow.

Our Wichita State University Kansas SBDC staff will be glad to help you dig deeper into the information presented here and to help you develop a short-term cash flow, boost your marketing on social media, and deal with employee issues.

Financial Assistance - Federal

The U. S. Small Business Adminsitration offers loan resources and guidance for small businesses impacts by COVID-19.

SBA Economic Injury Disaster Loans

Please Note: SBA announced that it is unable to accept new applications for the Economic Injury Disaster Loan COVID-19 related assistance programs unless Congress appropriates more money.

Businesses affected by the coronavirus can take out low interest loans from the SBA. Loans are made available up to $2 million with an interest rate of 3.75% for small businesses and 2.75% for nonprofits with terms up to 30 years.

Eligibility

In addition to the entities that are already eligible for SBA disaster loans (small

businesses, private non-profits, and small agriculture cooperatives), the CARES Act

temporarily expands eligibility ito include business entities with 500 or fewer employees: Sole proprietorships, with or without employees, independent contractors, cooperatives

and employee owned businesses, tribal small businesses, and private, non-profits of

any size. You must have been in business as of January 31, 2020.

Details

- These working capital loans may be used to pay fixed debts, payroll, accounts payable, and other bills that could have been paid had the disaster not occurred. The loans are not intended to replace lost sales or profits or for expansion.

- Loans can be approved by the SBA based solely upon an applicant’s credit score. No tax return is required.

- Loans smaller than $200,000 can be approved without a personal guarantee. SBA is not requiring real estate as collateral and will take a general security interest in business property.

- The first payment is due 12 months after the funds are issued.

- You may request an advance of up to $10,000 to pay allowable working capital needs; the advance is expected to be paid by the SBA within 3 days. This advance is essentially a grant and is not required to be repaid, even if the application is denied. However, the amount of the advance must be deducted from any loan forgiveness amounts under a Paycheck Protection Program loan.

- NOTE: The SBA announced changes to the EIDL program on April 6. Because of high demand, a $1,000 cap per employee on the advance was instituted up to a maximum of $10,000.

- There is no cost to apply.

- There is no obligation to take the loan if offered.

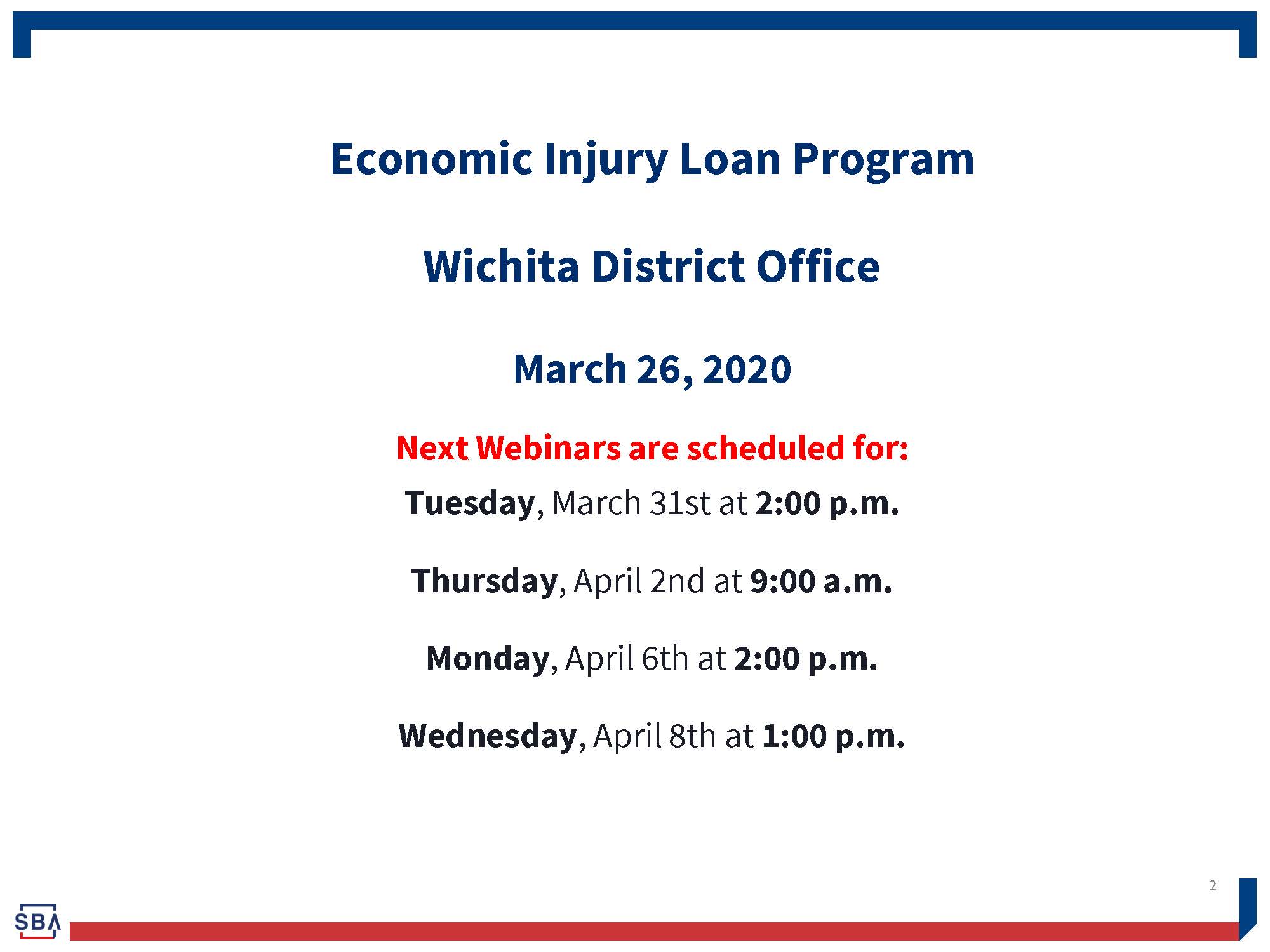

Webinars on the Economic Injury Disaster Loan

U. S. Small Business Administration Wichita District Office SBA Disaster Loan Presentation

How to Get Up to $10,000 or More from Uncle Sam for Your Business This webinar provides information about the advance grant of up to $10,000 offered as a part of the Economic Injury Disaster Loan as well as information about the EIDL loan and the Paycheck Protection Program. Three case studies give insight into practical applicaiton of these programs for small businesses.

Facebook Live Discussion about SBA Disaster Loan Angie Elliott of the Wichita Regional Chamber sat down with Wayne Bell of U. S. Small Business Administration (SBA) to talk about the SBA Disaster Relief program via Facebook live on March 23. Thanks to our resource partners for this timely and helpful discussion.

SBA Disaster Loan Webinar with Will Katz, University of Kansas SBDC

Will Katz, Regional Director of the University of Kansas SBDC Regional Center shares

information and thoughts on the new loan program.

SBA Express Bridge Loans

These loans allow small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork. Applicants can request up to $25,000 with a fast turnaround. The loan will be repaid in full or in part by proceeds from the EIDL loan.

Work with your SBA Express Lender or find an Express Bridge Loan Lender by connecting with the Wichita District SBA Office.

Paycheck Protection Program

Please Note: SBA announced that it is unable to accept new applications for the Paycheck Protection Program unless Congress appropriates more money.

The CARES Act Paycheck Protection Program signed into law March 27, 2020 is an extension of the Small Business Administration 7(a) program. SBA needs to develop rules to be implemented by the 1,800 banks that are part of the program, so you cannot apply yet. For you to participate you will need to contact a bank.

The loan is intended to cover an eligible borrower’s payroll, mortgage interest, rent and/or utilities expenses for up to eight weeks from origination of the loan.

Under this program:

Eligible recipients may qualify for a loan up to $10 million determined by 8 weeks of prior average payroll plus an additional 25% of that amount.

Loan payments will be deferred for six months.

If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first 8 weeks of payroll and certain other expenses following loan origination.

The National Law Review provides a summary of the CARES Act Paycheck Protection Program, and the U. S. Chamber of Commerce provides a helpful Paycheck Protection Program Small Business Guide and Checklist.

Kansas Hospitality Industry Relief Emergency (HIRE) Fund ![]()

The Hospitality Industry Relief Emergency (HIRE) Fund will provide bridge loans for Kansas’ hospitality sector during the COVID-19 crisis.Eligible businesses in Kansas will be able to apply for a one-time loan of up to $20 thousand at 0% interest for a period of 36 months. There will be no principal or interest payments for the first four months. Decisions on loan applications will be made within 72 hours of application receipt,

7 days a week. Funds will be transferred within 48 hours of approval.

UPDATE

Due to the overwhelming initial response, all initial funds available through the HIRE Fund have been allocated at this time. However, the Kansas Department of Commerce will keep the form open and will continue

to collect information from Kansas hospitality businesses on the losses they are facing

due to the COVID-19 pandemic. By filling out the form, you will help KDOC assess the

need across our state and continue to communicate with officials at the state and

national level.

Kansas Department of Labor

Kansas Department of Labor website Kansas Department of Labor Facebook page

The website and Facebook page both have Frequently Asked Questions and daily updates

for Kansas and information from the U. S. Department of Labor. The Kansas Department

of Labor is conducting weekly Wednesday Facebook LIVE Updates from Secretary Delia

Garcia & daily morning Updates from Secretary Delia Garcia and Unemployment Insurance

Director Laurel Searles and UI team.

Employer's Guide to COVID-19 presented by Timothy A. Davis with Constangy, Brooks,

Smith & Prophete as of April 2

Employer's Guide to COVID-19 presented by Timothy A. Davis with Constangy, Brooks,

Smith & Prophete as of April 2

Employer's Guide to COVID-19 presented by Timothy A. Davis with Constangy, Brooks,

Smith & Prophete as of March 25

Employer's Guide to COVID-19 presented by Timothy A. Davis with Constangy, Brooks,

Smith & Prophete as of March 25

The U.S. Senate Committee on Small Business & Entrepreneurship has published The Small Business Owner’s Guide to the CARES Act. This helpful guide covers:

- The Paycheck Protection Program, which provides capital to cover the cost of retaining employees;

- The Emergency Economic Injury Grant, which provides a quick infusion of a smaller amount of cash to cover immediate business needs, and Economic Injury Disaster Loans;

- The Small Business Debt Relief Program, which helps small businesses keep up with payments on a current or potential SBA loan;

- Small business tax provisions.

Partner Resources

Our resource partner organizations offer resources and expertise in specialty areas

that might benefit you.

OSHA: Guidance on Preparing Workplaces for COVID-19