IRS 1095-C Tax Form

About the IRS 1095-C Tax Form

Due to the Affordable Care Act, the IRS 1095-C form (proof of medical insurance) will be made available to benefits-eligible state employees for use in filing their taxes. Similar to a W-2 or 1099 form, employees will need to have it if they prepare their own taxes, or to provide to their tax professional who assists them with filing their taxes.

During enrollment, employees are asked to opt in or opt out of electronic distribution of this form. Employees who opted out of electronic distribution will receive a hard copy of the 1095-C mailed to their home address. Employees who opted in to electronic distribution will access their 1095-C through the State Employee Health Plan (SEHP) Member Administration Portal (MAP). All employees may electronically access their 1095-C, even if they previously opted out of electronic distribution.

How to access 1095-C

- Log into the Member Administration Portal (MAP). Log-In credentials match your Open Enrollment login ID and password. Note: If you have forgotten your login information, you can re-register by clicking on the "Register Now" button. Your State Employee ID (aka SHaRP ID) can be found by logging into myWSU.

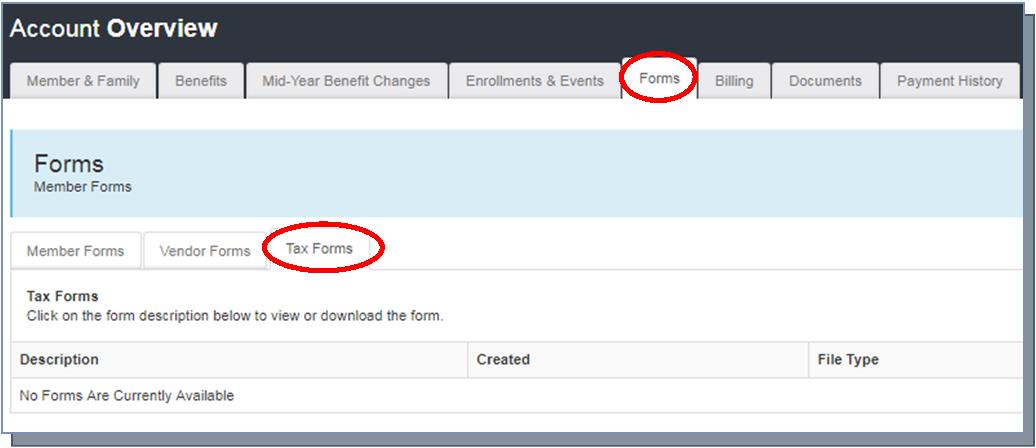

- Once logged in, the form is located in the Forms tab, under Tax Forms. When the forms are available, they will appear in the list below.

Who to Contact

For questions concerning your IRS 1095-C Tax Form or the SEHP Member Portal, email the State Employee Health Plan at: SEHPMembership@ks.gov

SME: CT/SDM

Reviewed: 12/17/2025 SDM